Brookfield REIT

Verdict: Unattractive

IPO Snapshot:

Brookfield India Real Estate Investment Trust (REIT) is launching a Rs. 3,800 crore IPO, between Wed 3rd Feb to Fri 5th Feb 2021, in the price band of Rs. 274 to Rs. 275 per unit. The 100% fresh issue proceeds will be used to repay debt, with 75% issue reserved for institutional investors and 25% for HNIs and retail (combined), having minimum ticket size of Rs.55,000 (200 units at Rs. 275 each). Listing is likely on 17th Feb with trading lot of 100 units.

Returns to Unit holders comprises of 2 components:

Brookfield REIT generates lease rental from 10.3 million square feet (msf) commercial portfolio in Gurugram, Noida, Mumbai, Kolkata with 3.7 msf under future development. Its unit holders (REITs do not have shares) will earn return in 2 forms:

- Yields in the form of dividend (80-85% of payout) and interest. While dividend will not be taxed in the hands of unit holders as REIT will bear it under the old income tax regime, interest component will be taxed as per individual’s tax liability at effective marginal tax rate, based on income level. On FY23E guided yield of 8.43%, post tax yield is 5.97%, assuming individual tax payer’s income between Rs. 50 lakh to 1 crore. If income is higher, this effective yield will lower and vice versa.

Mindspace REIT is currently quoting at pre and post-tax FY23E yields of 6.58% and 6.43% respectively, even after appreciation in unit price post listing, making Brookfield’s offering unattractive.

- Capital appreciation reflects change in value of assets held by the REIT, which is typically 3%-5% over a longer term for commercial assets. Holding period for capital gains on REITs is 3 years, unlike 1 year for listed equity shares. Thus capital gains on REITs held for 1-3 years will be taxed at 15% against 10% for equity shares held for same duration, effectively reducing post-tax returns of unit holders.

Since its listing, Embassy REITs performed well in the declining interest rate scenario, but going forward, in a few quarters, interest rates may start to rise as current rates have bottomed out and massive amounts of stimulus may lead to inflationary pressure, limiting capital upside as yield and unit prices are inversely related.

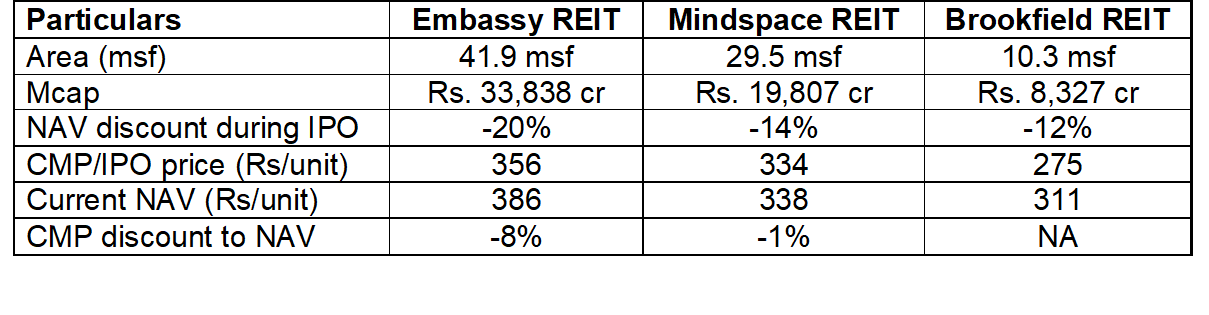

Peer Comparison:

At Rs. 275 per unit, issue is at 12% discount to NAV, whereas peers Embassy and Mindspace had launched respective IPOs at 20% and 14% discount to NAV. Even today, Embassy is quoting at 8% discount to its NAV, indicating discount can continue post listing for Brookfield too.

Due to heavy dilution being undertaken to pay off Rs. 3,575 crore debt of total Rs. 6,845 crore, Brookfield’s post listing stake will shrink to 54%, which may decline further when more assets are acquired by the REIT in the future.

Outlook on equity market remains bullish on a decisive growth-oriented budget, combined with surplus global liquidity headed to an attractive emerging market like India, titling out our preference towards equity vis-à-vis debt or hybrid products like REIT.

Conclusion:

Unattractive yield over peer and expected rise in interest rates over next few quarters make the risk reward unfavourable. Hence, we advise giving Brookfield REIT a ‘miss’.

Grey Market Premium of Brookfield REITs: Grey Market Premium of Brookfield REITs is an unofficial figure, against guidelines of SEBI and we are strongly against it. To know how it operates, read our article ‘grey market premium’

Disclosure: No interest.

16th Feb 2021 at 09:56 pm