Multibagger Stocks

Last updated : 17th Dec at 01:02 pm

What is a Multibagger Stock?

A Multibagger stock is an equity stock which gives a return of more than 100% i.e. investment in a stock more than doubling. A stock that doubles its price is called two-bagger while if the price grows 10-times, it would be called a 10-bagger. Thus, Multibagger are stocks whose prices have risen multiple times their initial investment values.

The term was coined by Peter Lynch in his 1988 book, One Up on Wall Street and comes from baseball where "bags" or "bases" that a runner reaches are the measure of the success of a play.

Please note that the examples given here are only for understanding and NOT recommendations to buy these shares now, since they might have already grown multi fold.

Key Attributes of A Multibagger Stock:

To begin with, one can start working with following set of basic information, which are more often than not are precursor to a Multibagger Stocks

- Market Leadership: Generally, Multibagger stocks are of companies that are market leader in their business. In this case, it may not necessarily be a large cap company. Infact, one the best ingredient for a Multibagger Company is Market Leadership with small market cap. Example: PPAP Automotive – Now it is gaining traction among analysts, but couple of years ago, it was available at market cap of Rs. 100 crores despite being leader in Sealing system solutions for car. Now, market is over Rs. 580 crores. Similar case in point would be Sterlite Tech, which kept trading at PE of 26-30x and yet rose from Rs. 90 to Rs. 414 in less than 3 years. Those who thought valuations are expensive, missed the bus. Here we must highlight that with superior earnings growth and market leadership positions, valuations can become very expensive and yet stock can keep rallying!

- Robust Business Model: The first sign of robust business model is Debt Free Balance-sheet with High RoE. The moment you get a market leader + small market cap + Debt Free + High RoE, you are very close to finding your Multibagger. E.g. Jamna Auto. It is very important to be cautious on High Debt companies, as interest burden in a tough environment can lead to losses and stock can lose multiple times rather than rising multifold.

- Promoter / Management: Efficient promoter / management (MD & CEOs) generally have great influence on valuations, apart from EPS, as markets tend to give higher valuations to companies with credible management. One way to feel secure on this front is listening to conference calls and tracking changes in promoter shareholding.

- Earnings Growth: Ultimately, it is earnings and earnings only that makes or breaks a stock. What it does today, tomorrow or next day is mere distraction. You must think that how much a particular company needs to earn in order for market cap to rise more than 10-15x. If you believe the company can do that, that’s your Multibagger.

- Trend: Generally, majority of Multibagger stocks born in a sector with Trend Upside. Like commodities in 2017 where smaller players like Pondy, Nile, Maithan etc gave Multibagger returns. There is always a trend available to play in the market. Most important thing is to avoid buying Trend Stocks, once the trend is over, as they will keep going down and when everyone is tempted to buy, the story is pretty much over!

- Valuations: Deep valuations discount as compared to Peers and Industry, coupled with earnings growth, can create Multibagger Stocks. eg. Universal Cables

- Holding Period: In stock market, Time is more important than Timing The Market. A stock can deliver 200-300% returns in 3 months as well and it may take 3 yrs as well. Happening this in 3 months happens to few in millions. Once convinced about the enormous potential of a company, one must invest with Long Term view of at-least 2 to 3 years. However, he might get lucky and get multifold returns few months only, but one cannot keep this in mind while making in investment, expecting Multibagger gains.

Things to know about multi-bagger stocks:

- Before you start researching multi-bagger stocks, here are few things that you should know about them.

- Multi-baggers are those companies who are financially strong and has a good business model that can be scaled within a short period of time.

- What really makes a stock multi-bagger is “Time + Continuous growth”. If a company is delivering continuous growth for a longer sustainable period of time, then it would turn out to be a multi-bagger in the future.

- These stocks take a long interval of time (5-15 years) to become a multi-bagger. That’s why you need to have a high degree of patience while investing in these stocks. If you are gonna book a profit of 60-70% after 10-12 months, then you might never be able to get a multi-bagger stock. Maybe, you’ll find it but you’ll not be able to get maximum profit out of it.

- In order to hold multi-bagger stocks, you need to understand the business. Only after doing so, you can be confident and patient enough to hold the stock for several years.

- Historically speaking, small and mid-cap companies have given the most number of multi-bagger stocks. However, this doesn’t mean that large-cap companies cannot become multi-bagger stocks.

- Don’t feel bad if you missed a few multi-baggers in the past. Even if you are able to find and hold just One multi-bagger stock in your portfolio, your overall returns will be amazing.

Known traits to find Multi-bagger stocks

- Growth at a reasonable price (GARP) stocks: Instead of investing in entirely ‘growth’ or entirely ‘value’ stock, select growth at a reasonable price (GARP) stocks, which has the mixed characteristics of both growth and value stocks. This can help you find a growing company without overpaying for it.

- Turn-around stocks: These are those companies who once got beaten badly by the market, however, now are getting back on the track.

- Mis-priced opportunities – You can find multi-baggers returns by investing in those companies who have a good potential, however, either ignored by the market or is out of flavor for the investors.

- Structural or management change in the organization: If there’s a major structural or management change in the organization that can drive the growth of the company, then it may be a potential multi-bagger.

- Sustainable competitive advantage: If the company is one of the kind or have created an entry barrier for the competitors, then definitely it can give multiple times return in the future.

Buyer Beware (Caution on Traps In The Markets)

- Time to enter:

The biggest problem with retail investors is that they enter when it is time to exit. To enter at a right time, it is important to identify such stocks in advance else it becomes a sort of bull trap. As an investor, if you find that the stock has run-up considerably and the steam is fizzled out (Trend or Story is over) then there is no point taking the immediate exposure.

- Marketing Gimmick & Exit Rout To Big Fishes

In today’s market, certain part of community is prefixing the word Multibagger to sell a particular/basket of stocks. Adding a word Multibagger makes ordinary below avg company look very attractive and greedy and impulsive people rush buy, without taking even 1 day for them, to analyse basic things. Remember, it is truly Multibagger stock, you will make huge money even if you buy after 50% rise! Be patient and check facts.

Myths About Multibagger Stocks

- It must be right since it’s in the Media / Social Media

People have a very big misconception that Media / Social Media is there to help you in making money. Rather they are classic example of Pickaxe & Shovel Theme. During Great Goldrush of California, all the people ran to dig Gold. However, few started selling Pickaxe and Shovel to let them dig. Who do you think made most money? The ones who were digging for Gold or the ones who were selling Pickaxe & Shovel?

- I won’t sell until I recover my capital

If you really agree with this view; it means that your ego is taking the lead. It’s better to stay calm and take a decision after proper analysis. An analysis can go wrong as much moving parts and future projections are involved. In such cases, the best option is to evaluate the information at hand, rather than simply holding on in hopes of recovery.

- This stock is down 90%, how much it can fall more

This is one of the biggest of all mistakes which most people do. Say XYZ company which was priced at 200 a few months back, is currently quoting at Rs 10. Suppose you bought 100 shares at Rs 10 and since the stock has already corrected 90% so you may think that the only risk is Rs 10 per share. But say in a month’s time, it came down to Rs 2. In absolute terms, it’s just a loss of Rs 8 but in a relative sense, you have already lost 80 % of your capital. So, you need to analyze accordingly. It’s better to analyze company’s fundamental than the percentage fall of the stock.

- You have to be a genius to make money in the stock market

Most people say that you need to make a lot of analysis and calculations in order to analyze a stock, but it has been found that big and highly qualified fund managers have failed to even beat the market while on the other hand, many common investors have outperformed the market simply by applying common sense and general observations.

- Let’s borrow money to buy more of it

This is another term which is popularly used by the stock brokers and fund houses to dump their stocks and to fool people. So be very careful, when you come across this term and rather carry a detailed analysis in case of these stocks.

Bottomline

Never underestimate yourself since self belief & an independent mind set are needed to be a successful investor. Always keep in mind, that you yourself are capable of managing your money. Happy investing!!

Please note that the examples given here are only for understanding and NOT recommendations to buy these shares now, since they might have already grown multi fold.

Rules to Follow when acting on our calls

- This is a Long Term Investment Section. Do not put more than 10% of your equity funds in all calls put together. Never put more than 2% of your equity funds in one stock.

- Along with the limits on allocation for all calls in this section, stock level limits should be followed strictly. As a thumb rule, NEVER invest more than 10% of your equity funds in a single Large Cap Stock, 6% in a single Mid Cap Stock, 4% in a single Small Cap Stock and 2% in a single Micro Cap Stock. For additional guidance, enter your portfolio in My Portfolio section to get alerts on such common errors.

- These stocks need to have a view of 3 to 5 years, which is the minimum holding period criteria for Multibagger stock.

- Section is giving yearly target, which if held for 3 to 5 years will give Multibagger returns.

- Take them as long term, high growth, thematic calls. Avoid SL concept, which is defeating investment objective of this column. Those who want to exit in case of loss should put a SL of 25% of your cost.

- Multibagger Stocks are never frontline stocks, but stocks which are presently ruling low, but having future growth potential, either due to business cycle or management capability.

- These are pure Investment calls and strictly advised to AVOID them trading in Futures & Options segment. These calls can be purchased in cash by all members having Growth, Balanced and Conservative profile.

- Members take note of paying delivery brokerage of not more than 0.20% + STT to enable members to make profits on these calls.

- We try to have between 4 to 6 active calls in this section and try to provide about 1 call in a month in this section. Number may vary as per market conditions.

- Disclosure: Our interest in the call is given in the Disclosure column. 'Have Interest' implies we have holding in the stock, while 'No Interest' means we do not have any holding in the stock.

- Rationale for advise: Calls in this section has been given based on fundamentals, recent news flows and valuations, as observed in the market and in the stock.

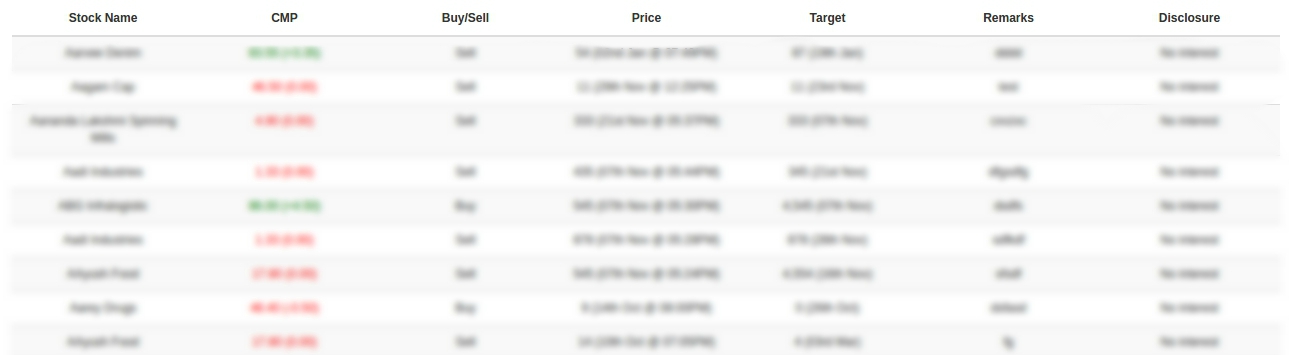

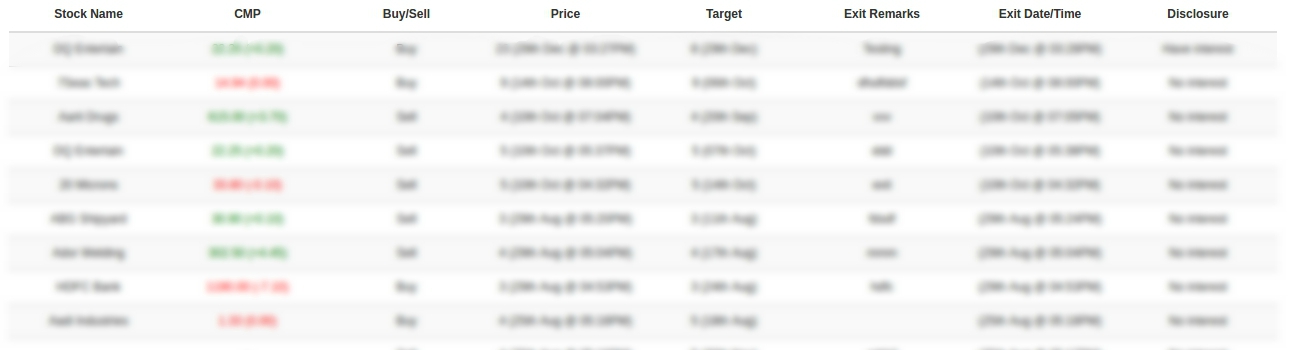

Archives (Last 30 calls)

Popular Comments

|

Sivasankari P

28th Sep 2025 at 02:11 pm |

Thanks for all the profit and guidance.

|

|

Manjiv Kaur

28th Aug 2024 at 08:26 am |

Sir , I’m so lucky to be Encored by you . I have great respect and regard for you .

|

|

Kiran Naikwadi

22nd Mar 2024 at 08:02 pm |

Sir. your are God to small invester cg power. Hind copper. Thanks to all profit sir.

|

|

Rohit Sahasrabuddhe

11th Jan 2024 at 11:40 am |

Thanks for valuable guidance started to make profits in market after following your guidance

|

|

Anil Kumar

18th Nov 2023 at 12:55 pm |

Thanks a lot for valuable guidance

|

|

I B Satheesan

1st Nov 2023 at 08:55 am |

Thanks for valuable advice/ Good profit made from JITF, Pat Eng,Jain and CG. and partially booked profit.

|

|

Rajeev Jain

20th Oct 2023 at 03:50 pm |

Many Thanks for all your guidance.

|

|

Sudhir Saharan

17th Sep 2023 at 10:34 pm |

SUZLON@JITF@PATEL@JAIN@GMR@CG@SUPER PROFIT

|

|

Manish Shah

13th Jul 2023 at 02:24 pm |

East or west SPTis the best

|

|

Manish Shah

5th Jul 2023 at 08:50 pm |

You r god to.guide nd save us

|

|

Anita Dhania

29th Nov 2022 at 11:23 am |

Hi Sir, are there any multi-bagger recommendations available?

|

|

Vidyadharan C R

29th Nov 2022 at 08:48 am |

Thanks for your

Valuable advice for stocks

|

|

Kiran Naikwadi

21st Jul 2022 at 04:56 pm |

Sir ???????. ?????? ?????? ???? ??? ???.Aug 20 ?? ?? Tv ???? ?? ????? Invested God*

|

|

Kiran Naikwadi

13th Jul 2022 at 06:20 pm |

I buy cg power 4001@58 sell 1000Q @186 3001 hold. Great sir.

|

|

Nehru T M

30th May 2022 at 11:13 pm |

Happy Birthday Sir. You've had quite an impact on our family's financial wealth. Lord Balaji may shower his blessings on you.

|

|

Srinivasulu Pitchuka

17th Feb 2022 at 07:44 am |

even in war apprehensions also without panic we buy guruji recommendation shares and get profit .we are lucky thak ;you sir

|

|

Akila

20th Dec 2021 at 08:38 am |

If we have given a buy call of JiTF at 292 and if a member has bought at that price, if the stock has fallen 50 percent, why do we call him as greedy member ??

|

|

Sudhir Saharan

17th Oct 2021 at 02:48 pm |

JITF INFRA is very good stock I like it

|

|

Sudhir Saharan

17th Oct 2021 at 11:55 am |

Thanks sir I Buy jitf 7000 shere on price 43.90 and now 320.45

|

|

Subhendu majumder

29th Jul 2021 at 12:08 pm |

sir multibagger stock recommendation detail analysis page

|

|

Pradeepta Sethy

2nd Jul 2021 at 05:23 pm |

Superb pick up at damn chap price

|

|

Debabrata Mondal

28th May 2021 at 11:00 am |

SIR, WISHING YOU MANY MANY HAPPY RETURNS OF THE DAY . WORLD NEED THIS EVER YOUTH, PURE SOUL MAN LIKE YOU. STAY SAFE STAY IN PEACE.

|

|

Srinivas Karnamadakala

10th May 2021 at 12:16 am |

Made good profits in jayasneco , cg power and still holding it

|

|

Rama Chandra Murty Kavuri

6th May 2021 at 04:03 pm |

Pranams to Tulsian gi. You are an embodiment of intellect and values. Made good profits. Delayed to express gratitude out of some phobia to operate.please condone me

|

|

Tarun (Guest)

10th Jan 2021 at 05:52 pm |

Pi which is developed by Stanford PhDs. would highly recommend to try your luck.

link: https://minepi.com/Tks001

Code: Tks001

|

|

AMIT BHATT

5th Dec 2020 at 10:32 am |

In MLeod Russel seems operator game started as was in LC yesterday. Sir please advise and save small member investors with your kind advise.

|

|

AMIT BHATT

3rd Dec 2020 at 07:22 pm |

Joined today-Hppe to gain. Holding CG power and Jaib Irrigation-DVR. Will add Jain Irrigation as per Multibegger recommendation.

|

|

Jayesh Motwani

13th Sep 2020 at 01:43 am |

Just joined, let see cost benefit being member

|

|

MOHAN YADAV

31st Aug 2020 at 02:03 pm |

Overall good but no one can say 100% accurate. After all it is share market which has inherited fluctuations and uncertainty

|

|

S Sivasankari

1st Aug 2020 at 02:20 pm |

Thanks sir for your guidance

|

|

Vipin Kumar Yadav (Guest)

25th Jul 2020 at 11:15 pm |

sir what will happen to jp infra future

|

|

R Baskar

24th May 2020 at 11:36 am |

Thank you sir for your accurate guidance.....

|

|

Nagalla Sekhar Babu

10th Feb 2020 at 02:44 pm |

iam longterm investor please advice selection of shares as multibagger

|

|

Manish Shah

3rd Jan 2020 at 10:16 pm |

All trading calls since last 6 months are fantastic, It takes time and patience checked. Ultimately 90% above are met with target. Great !

|

|

Manish Shah

3rd Jan 2020 at 10:07 pm |

Your investment calls r awesome. Morethan 10% gain in indian toner. Great and God bless you. Your r in this earth to survive people like us.

|

|

nice call (Guest)

6th Jul 2019 at 11:15 pm |

I joined and it works great.

|

|

Nirmal Kumar M Chandria

25th May 2019 at 10:45 pm |

I have lot of stuck positions due to wrong advises from investment advisors pl give us time to discuss all positions are in F&O

|

|

AJIT CHAVAN

8th Feb 2018 at 08:31 pm |

sir recently i joined your services but the result are very awesome...

|

|

Kalavathy

21st Jan 2018 at 08:53 am |

Most of the stock's are reached high after reco here..

|

|

DEBABRATA MONDAL

1st Jan 2018 at 09:49 pm |

A real Five Star Adviser. Full Respect to you and your team.

|

|

Bashab Jalui

15th Dec 2017 at 06:58 pm |

In this sections we need only patience.

To earn money.

Thank you sir for giving us such huge profitable calls.

|

|

Balasubramanya Raje Urs

11th Dec 2017 at 06:34 pm |

Dear members please read every word in multi baggers section

|

|

Chhaya Paresh Mehta

8th Dec 2017 at 09:56 am |

I want when we receive calls it’s already up

|

|

Amit Kumar Jayswal

28th Nov 2017 at 04:54 pm |

used to watch CNBC daily for clues to buy a new scrips/movement of stocks..Nw a days I m using tat time for my family..earning Gud profit..thanks to SPT family.

|

|

Ravi Kumar Gullapalli

24th Nov 2017 at 05:40 pm |

In a multi-bagger section, why are stocks being listed with even Rs. 4 - 6 gain as target? Should this section not include gains of only 2X or more?

|

|

Shashi Kant

11th Nov 2017 at 07:47 am |

Highly impressed by the vision, accuracy, honesty and transparency of Sh. SP Tulsian ji and his team

|

|

Munish Jindal

10th Nov 2017 at 11:20 am |

excellent section..

|

|

Suraj Gupta

4th Nov 2017 at 10:20 am |

Hello sir

I want to invest in cheap multi bagger arock for a period of 3 to 4 years kindly advice

|

|

Nachiket Ozarkar

16th Oct 2017 at 05:33 pm |

Patience n conviction what I could learn from u Sir a big salute to you Holding 90% of recommended stocks a big Thank You for 360 degree change u made Into the way One should operate equity

|

|

Nachiket Ozarkar

15th Oct 2017 at 12:43 am |

Multibagger ideas are for 3 to 5 years that itself suggest the time horizon still members get panic and ask any realisation of expected value my god !!

|

|

Sachin Hukku

28th Sep 2017 at 07:37 pm |

At this time all Investment ideas are trading lower than where they were recommended. May be its mkt current pace. Hoping for good...

|

|

Anand Kumar Bajaj

23rd Sep 2017 at 11:57 pm |

When every one can not read all SQ answers, how SP Tulsian ji manages to answer so much of SQs. Great work! Anand K Bajaj

|

|

Rahul Kashyap

23rd Sep 2017 at 12:43 am |

Sir,

Can you please recommend few multibagger ideas where the company is debt free.

Thank you.

|

|

Madhu Matcha

18th Aug 2017 at 01:33 am |

Impressed with Sirs recommendations and Joined in this Zone. Greeting s to all of you and post your valuable suggesstions here.

|

|

Harish Varadrajan

16th Aug 2017 at 10:07 am |

With regard to Sir's MB recommendation, one just have to buy with convection and hold with open mind. the returns will be phenomenal.

|

|

P Sambaiah

15th Aug 2017 at 04:41 pm |

why mb stocks are having low target prices i.e, range of buy price and target price is low

|

|

DJose (Guest)

4th Aug 2017 at 08:16 pm |

Jayant Agro, DCM Shriram, Dwarikesh Sugar...all multi baggers within a year. I never experienced this kind of awesome results. Highly recommend his service for medium to long term investors.

|

|

Bashab Jalui

29th Jul 2017 at 12:13 am |

great calls.all calls are profit making.

|

|

raja (Guest)

11th Jul 2017 at 12:52 am |

Now we can have the profits in the shares by investing in the tube investment

|

|

Santhosh Kumar

24th Apr 2017 at 09:58 pm |

Xllent investment ideas from the Guru of Stock mkt. such a knowledge and experience with sharp on to tgts........Thanks a lot.

|

|

Manjunath DH

2nd Mar 2017 at 01:39 pm |

20th Feb is in future also bhai

|

|

mansiha balsara

1st Mar 2017 at 07:06 pm |

Why 1st march call has tgt date of 20th feb? Am i missing on something? Can someone guide me on this.....

|

|

Ajay

1st Mar 2017 at 02:55 pm |

Am I reading correctly or is it data issue. J P Infratech Target shows 16 (20 Feb). 20th Feb is in the past.

|

|

mansiha balsara

16th Feb 2017 at 01:32 pm |

Thought MB will have have longer time frame as mentioned also the tgt price with multiple time gains as it is a long term story. Are these calls is still valid? then what is the tgt price?

|

|

Chandra Bhushan Pandey

13th Feb 2017 at 12:37 am |

A multibagger

stock must atleast double your investment.

Looking for some such calls from you.Stocks at early stage with huge growth potential.

|

|

S.KRISHNA

8th Feb 2017 at 08:34 pm |

God made you to create wealth of our's. Your recommendations are excellent. Thank you sir.

|

|

Ramaswamy Gopalan

8th Feb 2017 at 07:52 pm |

M'bagger is suppose to be LT investment but tgt closed are short. I do not understand. Are these are still valid for LT ? Then aarpx LT target? Pl clarify

|

|

SURESH KUMAR

7th Feb 2017 at 09:54 am |

Excellent profit in OUDH SUGAR..Heartly wishes and happy to be with your association.

|

|

Ajay Dhayani

2nd Feb 2017 at 03:27 pm |

cheeta ke chaal aur SPT sir ke stock selection ko kabhi bhi sandeh nahi karte........happy to be with you sir...

|

|

asad

25th Jan 2017 at 01:01 pm |

sir ki calls stock ke liye order ka kaam karti hai bhaag stock bhaag

|

|

Shankar Shanmugam

23rd Jan 2017 at 07:06 pm |

I find it very difficult to catch any of the Quicky stock calls today. It either reaches the target or goes beyond the target within 1-2 mins or comes back after hitting the target.

|

|

Mahesh agarwal

22nd Jan 2017 at 12:52 am |

Excellent advice sir

|

|

Kalpesh M V

11th Jan 2017 at 05:05 pm |

Thank you Sir, Excellent. Made good profit on yest erday's call DCM Shriram inds. Fantastic.

|

|

SK Prasad

6th Jan 2017 at 12:45 pm |

Dear SPT friends.. I could get returns within 7 days after becoming member for which I waited with mutual funds for 14 months!! Greatest stock advisor in Asia region.. Thank y ou sir!!

|

|

Swaminathan Gopalakrishnan

28th Dec 2016 at 04:39 pm |

Excellent call on Bharthi Financials..

|

|

Srinivasarao Doppalapudi

23rd Nov 2016 at 11:10 pm |

SPT sir..you are Mr.dependable...great calls and good analysis..

|

|

alok

5th Nov 2016 at 08:24 pm |

Excellent

|

|

K.Nivedan

1st Nov 2016 at 05:35 pm |

Impressed with the stock recommendations by Mr.S.P.Tulsian,particularly Deepali recommendations.Hence became a member immediately.

|

|

JAY ASHWIN GALAIYA

1st Nov 2016 at 03:48 pm |

HAPPY NEW YEAR

EXCELLENT ADVISE FOR INVESTORS FRO M YOUR SIDE.

ONE WORRY WHICH SPRUNGS UP IS ARE THEY GONE BAN ON EQUITY ADVISORY AS REPORTS FROM MEDIA CHANNELS ALTHOUGH THEY SAY ADVISORS UNREGISTERE D WITH SEBI AND ALSO MODERN MEANS LIKE APPS MAY BE BANNED

|

|

ASHOK RUPANI

27th Oct 2016 at 11:12 am |

I have heard lots of experts on the tv,

But honestly you are really GREAT,

|

|

DHIREN S DUTIA

25th Oct 2016 at 12:14 am |

Sp Ji ki nikli Sawari sp ji sab pe Bhari hum to h ai sp ji k aabhari sp ji k call se roj manate hai Diwali

|

|

kushal kalantri

25th Oct 2016 at 12:14 am |

Great stock picking. Ur genius. Rocking. Awesome. N much more.

|

|

ashishpatel

23rd Oct 2016 at 05:12 pm |

sirji what we people comment about you in one word I want to told whole wor ld you are a god blessed and faithful analyst for indian stock market

|

|

ashishpatel

22nd Oct 2016 at 09:32 am |

sir I join you yesterday but I am real fan of you you are such a genius I have never seen such analyst giving all details of company and also about fundamental thank you sir

|

|

Yogendranath

22nd Oct 2016 at 06:42 am |

Sir ..i am following markets from last 10 years ..but after joining ur service i got lot of confidence to earn money with ur calls..i joined on 20th oct ..with capital of 6 lacks ..let's see how it grow sir..thankq

|

|

Abhay Musale

21st Oct 2016 at 06:31 pm |

The stock recommendations by Mr. S P Tulsian are a wesome. I have never seen anyone identifying and p redicting future stock levels like him. Just by following him and trust on his recommendations will help investors to earn lot of wealth.

Appreciate his efforts for retail i nvestors.

|

|

ASHOK RUPANI

20th Oct 2016 at 12:07 am |

Its a pleasure to be a member

|

|

Rupesh Das

15th Oct 2016 at 11:20 am |

Sir, Only you can help me recover my money that go t burnt in the last 9 months. Sir, Please help me, I need your support

|

|

VIKRAM

6th Oct 2016 at 02:05 am |

FANTASTIC just superb. great knowledge and great service to retail. thanks

|

|

S. Shankar Raman

30th Sep 2016 at 05:04 pm |

Message to pksahu25!

MB stocks needs tracking and buy should happen @ reco mmended price. Its also happens that there is spurt following the recommendation. But they will probably fall to buy levels. Have conviction and faith in the expert ! There ar e very few or none like SPT for retail small investors! if you have conviction you will benefit @ 40-50% growth in your holding year after year! Trust followed by patience is paramount for making money in stocks! We need several years and one lifetime is not

|

|

P K SAHU

28th Sep 2016 at 02:13 pm |

Your today's multi bagger recommendations for Sund aram Brake and Auto Axle are impractical to follow. By the time your message reach me, the prices have substantially gone up or the original message is immediately followed by another message that the target has been met. It also happens with other kinds of recommendations also. I joined your service about a months back by being motivated by Mr Tulsian's deliberations on different TV channels. I am yet to benefit from his wisdom. I am now sitting in loss

|

|

Vinay

20th Sep 2016 at 10:28 pm |

great analyst SPbei98

|

|

Samir swain

19th Sep 2016 at 07:13 pm |

The Honest and the best till now I have seen, Kudos to Tulsian sir

|

|

Divyakant

15th Sep 2016 at 04:37 pm |

Dear Sir, I am new member since one month but conf ident that I will earn not less than 10 lacs in first year. Thanks for your excellent guidance & Rec ommendation. Sirji Hats of you.

|

|

Amit

1st Sep 2016 at 01:00 pm |

Thanks Sir. Excellent advise we keep getting from you. I have started making money in equities even when the market is low. THANKS for the the EFFORTS SIR

|

|

SUNIL K JHA

30th Aug 2016 at 02:21 pm |

No one speaks with as much conviction & panache as the one MR SP Tulsian do es. Market just laps it up every time he opens his lips . Every one follows him including the analys ts & I really wish him all the best .

|

|

SAMEER GUPTE

25th Aug 2016 at 10:28 pm |

Tulsian sir is god of stock market! this website is fantastic, complete in all aspects. Superb recommendations. Very professional team. Thanks for all the help in making money on stock market.

|

|

subhash jain

20th Aug 2016 at 08:31 pm |

No any word to say about yr confidence level about STOCK COMMENT i made big big profit and all my lo ss cover within last six month..NOW I. HAPPY WIITH MKT AND U

|

|

Praveen Nalwad

2nd Aug 2016 at 07:24 pm |

Sirji I pick stocks and trends seeing your comments on CNBCtv18. Its real time analysis with the facts.

|

|

KISHOR J RAIGANDHI

26th Jul 2016 at 02:40 pm |

SIR EXCELLENT RECOMMENDATONS EARNED GOOD PROFIT.

|